Which Of The Following Is The Most Useful In Analyzing Companies Of Different Sizes?

Financial Statement Analysis

Financial Statement Analysis

Financial statement analysis reviews financial data institute on financial statements to brand informed decisions nigh the business organisation. The income statement, argument of retained earnings, residuum sheet, and statement of cash flows, amongst other fiscal information, can be analyzed. The data obtained from this analysis can benefit decision-making for internal and external stakeholders and can give a company valuable information on overall performance and specific areas for improvement. The analysis can help them with budgeting, deciding where to cutting costs, how to increase revenues, and time to come capital letter investments opportunities.

When considering the outcomes from analysis, it is important for a company to sympathize that data produced needs to exist compared to others inside industry and close competitors. The company should also consider their past feel and how it corresponds to electric current and time to come functioning expectations. Three common analysis tools are used for decision-making; horizontal assay, vertical assay, and financial ratios.

For our word of fiscal argument analysis, nosotros will utilise Banyan Goods. Banyan Goods is a merchandising company that sells a diversity of products. (Figure) shows the comparative income statements and balance sheets for the past two years.

Comparative Income Statements and Residue Sheets.

Keep in mind that the comparative income statements and residuum sheets for Banyan Goods are simplified for our calculations and practice non fully correspond all the accounts a company could maintain. Let'due south begin our analysis discussion by looking at horizontal analysis.

Horizontal Analysis

Horizontal analysis (likewise known as trend assay) looks at trends over fourth dimension on various financial statement line items. A visitor volition look at one catamenia (unremarkably a year) and compare it to another catamenia. For example, a company may compare sales from their current year to sales from the prior year. The trending of items on these fiscal statements can give a visitor valuable data on overall performance and specific areas for comeback. It is nigh valuable to exercise horizontal analysis for data over multiple periods to meet how alter is occurring for each line item. If multiple periods are non used, it tin can be difficult to identify a trend. The year beingness used for comparison purposes is called the base year (ordinarily the prior period). The year of comparing for horizontal analysis is analyzed for dollar and percent changes against the base of operations year.

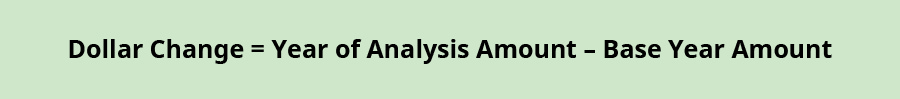

The dollar alter is plant past taking the dollar amount in the base of operations year and subtracting that from the year of assay.

Using Banyan Appurtenances equally our example, if Banyan wanted to compare net sales in the current year (yr of analysis) of ?120,000 to the prior year (base twelvemonth) of ?100,000, the dollar change would be as follows:

\(\text{Dollar change}=?120,000–?1000,000=?20,000\)

The percentage modify is institute by taking the dollar change, dividing by the base year corporeality, and then multiplying by 100.

Let's compute the percent change for Banyan Goods' cyberspace sales.

\(\text{Percentage change}=\left(\frac{?xx,000}{?100,000}\right)\phantom{\dominion{0.2em}{0ex}}×\phantom{\rule{0.2em}{0ex}}100=20%\)

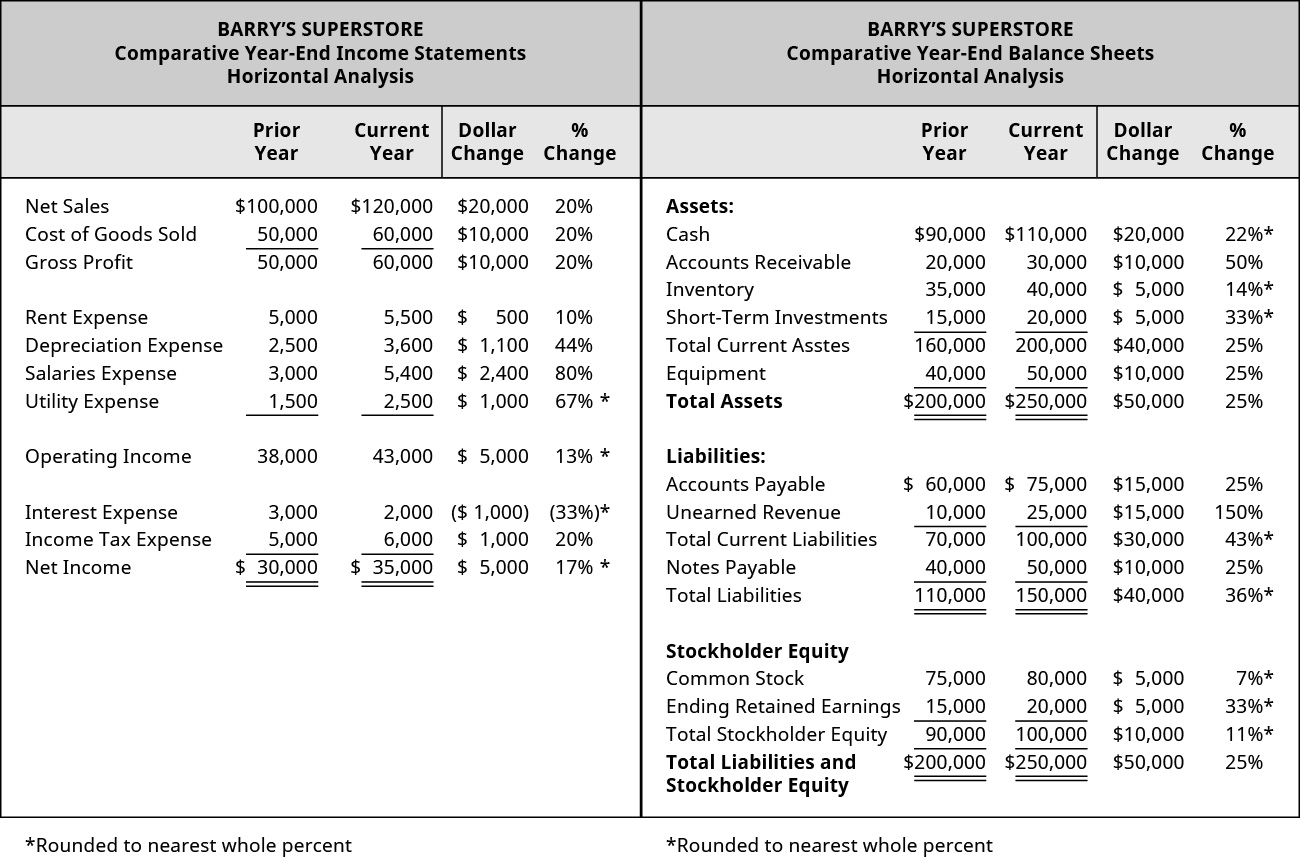

This means Banyan Goods saw an increase of ?20,000 in net sales in the current year as compared to the prior year, which was a xx% increase. The aforementioned dollar change and pct change calculations would be used for the income argument line items besides as the residue sheet line items. (Figure) shows the complete horizontal analysis of the income statement and residual sail for Banyan Goods.

Income Statements and Horizontal Assay.

Depending on their expectations, Banyan Appurtenances could make decisions to modify operations to produce expected outcomes. For example, Banyan saw a 50% accounts receivable increase from the prior year to the current year. If they were just expecting a 20% increment, they may need to explore this line particular further to determine what caused this difference and how to correct it going forward. Information technology could possibly exist that they are extending credit more readily than anticipated or non collecting as rapidly on outstanding accounts receivable. The company will need to further examine this difference before deciding on a form of action. Another method of analysis Banyan might consider earlier making a conclusion is vertical analysis.

Vertical Analysis

Vertical analysis shows a comparison of a line detail within a statement to another line item inside that same statement. For example, a visitor may compare cash to total assets in the current year. This allows a company to see what percentage of greenbacks (the comparison line particular) makes up total assets (the other line item) during the period. This is different from horizontal assay, which compares beyond years. Vertical analysis compares line items within a statement in the current year. This can help a business concern to know how much of one item is contributing to overall operations. For case, a company may want to know how much inventory contributes to full assets. They can then use this information to make business decisions such as preparing the budget, cutting costs, increasing revenues, or capital investments.

The visitor will need to decide which line item they are comparing all items to within that statement and and then calculate the percent makeup. These percentages are considered mutual-size because they make businesses within industry comparable past taking out fluctuations for size. It is typical for an income statement to utilise internet sales (or sales) as the comparison line item. This ways net sales will be set at 100% and all other line items within the income statement will represent a percentage of net sales.

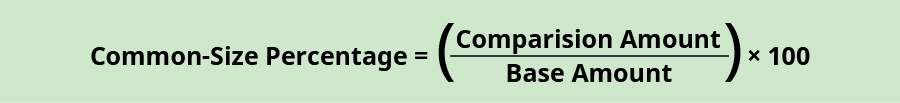

On the balance sheet, a company will typically look at 2 areas: (1) full assets, and (2) total liabilities and stockholders' equity. Total assets will be ready at 100% and all assets will stand for a percentage of total assets. Total liabilities and stockholders' equity will also be prepare at 100% and all line items inside liabilities and equity will exist represented equally a percentage of total liabilities and stockholders' equity. The line item set at 100% is considered the base amount and the comparison line item is considered the comparison amount. The formula to decide the mutual-size percentage is:

For example, if Banyan Goods set full assets every bit the base corporeality and wanted to see what pct of total assets were made up of cash in the current twelvemonth, the following calculation would occur.

\(\text{Common-size percentage}=\left(\frac{?110,000}{?250,000}\right)\phantom{\dominion{0.2em}{0ex}}×\phantom{\rule{0.2em}{0ex}}100=44%\)

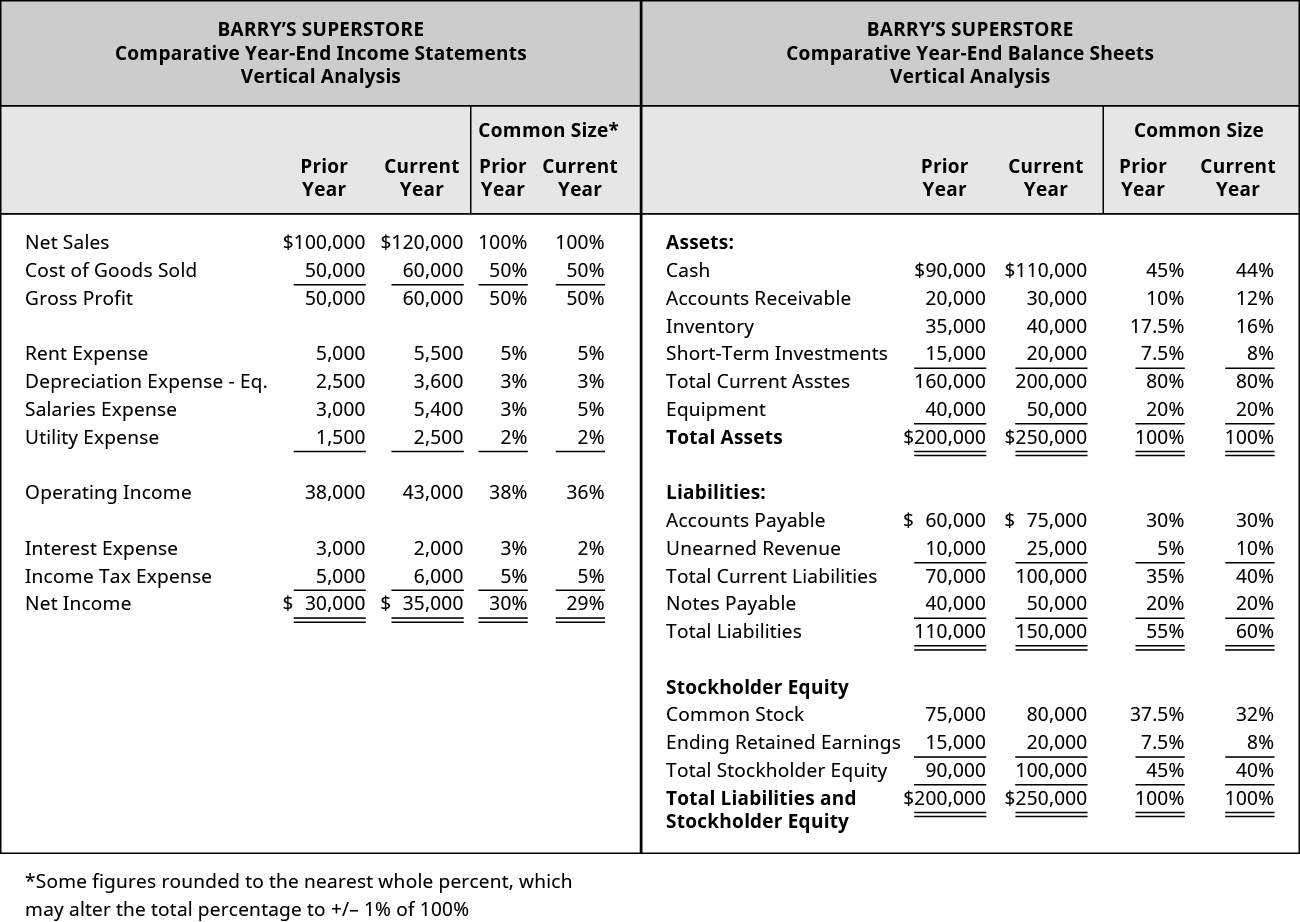

Cash in the current year is ?110,000 and total assets equal ?250,000, giving a mutual-size percentage of 44%. If the company had an expected cash rest of 40% of total avails, they would be exceeding expectations. This may not be enough of a divergence to make a modify, but if they observe this deviates from manufacture standards, they may need to make adjustments, such equally reducing the amount of greenbacks on hand to reinvest in the business. (Effigy) shows the common-size calculations on the comparative income statements and comparative balance sheets for Banyan Goods.

Income Statements and Vertical Assay.

Even though vertical analysis is a argument comparison within the aforementioned year, Banyan can utilize information from the prior year'southward vertical analysis to brand sure the business is operating every bit expected. For example, unearned revenues increased from the prior year to the current year and made up a larger portion of total liabilities and stockholders' equity. This could be due to many factors, and Banyan Goods will need to examine this further to encounter why this change has occurred. Let'south plow to fiscal statement analysis using financial ratios.

Overview of Financial Ratios

Financial ratios aid both internal and external users of information brand informed decisions most a company. A stakeholder could be looking to invest, become a supplier, brand a loan, or alter internal operations, among other things, based in part on the outcomes of ratio analysis. The information resulting from ratio analysis can be used to examine trends in performance, establish benchmarks for success, set budget expectations, and compare manufacture competitors. At that place are four main categories of ratios: liquidity, solvency, efficiency, and profitability. Annotation that while there are more ideal outcomes for some ratios, the industry in which the business operates can change the influence each of these outcomes has over stakeholder decisions. (Y'all will learn more about ratios, industry standards, and ratio interpretation in advanced bookkeeping courses.)

Liquidity Ratios

Liquidity ratios show the power of the company to pay brusque-term obligations if they came due immediately with avails that can exist apace converted to cash. This is done by comparison electric current avails to electric current liabilities. Lenders, for example, may consider the outcomes of liquidity ratios when deciding whether to extend a loan to a company. A company would like to be liquid enough to manage any currently due obligations but not also liquid where they may not be effectively investing in growth opportunities. 3 common liquidity measurements are working capital letter, electric current ratio, and quick ratio.

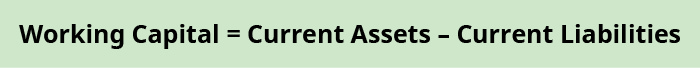

Working Uppercase

Working capital measures the financial health of an organisation in the curt-term by finding the departure betwixt electric current avails and current liabilities. A company will need plenty electric current assets to cover electric current liabilities; otherwise, they may non be able to keep operations in the future. Earlier a lender extends credit, they will review the working uppercase of the company to run across if the company can meet their obligations. A larger difference signals that a visitor can cover their brusque-term debts and a lender may be more than willing to extend the loan. On the other hand, too large of a difference may indicate that the company may non be correctly using their assets to grow the business. The formula for working upper-case letter is:

Using Banyan Goods, working majuscule is computed as follows for the electric current twelvemonth:

\(\text{Working capital}=?200,000–?100,000=?100,000\)

In this case, current assets were ?200,000, and current liabilities were ?100,000. Current assets were far greater than current liabilities for Banyan Goods and they would easily be able to embrace brusque-term debt.

The dollar value of the difference for working capital is limited given company size and scope. It is most useful to catechumen this information to a ratio to determine the company's current financial wellness. This ratio is the electric current ratio.

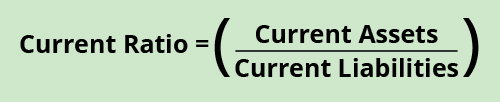

Current Ratio

Working capital expressed every bit a ratio is the current ratio. The current ratio considers the amount of current assets available to encompass current liabilities. The higher the current ratio, the more than probable the company can cover its short-term debt. The formula for electric current ratio is:

The current ratio in the electric current year for Banyan Goods is:

\(\text{Current ratio}=\left(\frac{?200,000}{?100,000}\right)=\text{ii or 2:1}\)

A two:1 ratio means the company has twice as many current assets as current liabilities; typically, this would be plenty to cover obligations. This may exist an acceptable ratio for Banyan Goods, only if information technology is too high, they may want to consider using those assets in a different way to grow the company.

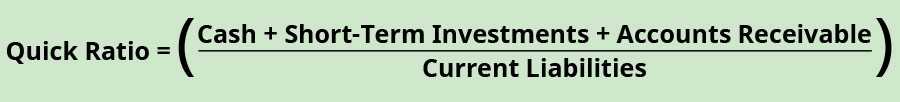

Quick Ratio

The quick ratio, also known as the acid-test ratio, is like to the current ratio except current assets are more narrowly defined equally the most liquid assets, which exclude inventory and prepaid expenses. The conversion of inventory and prepaid expenses to cash tin sometimes take more fourth dimension than the liquidation of other electric current assets. A visitor will desire to know what they take on hand and tin can use quickly if an immediate obligation is due. The formula for the quick ratio is:

The quick ratio for Banyan Goods in the current year is:

\(\text{Quick ratio}=\left(\frac{?110,000+?20,000+?xxx,000}{?100,000}\right)=\text{1.half dozen or ane.6:i}\)

A 1.6:1 ratio means the company has enough quick assets to encompass current liabilities.

Another category of financial measurement uses solvency ratios.

Solvency Ratios

Solvency implies that a visitor can meet its long-term obligations and will probable stay in business in the future. To stay in business the company must generate more revenue than debt in the long-term. Meeting long-term obligations includes the ability to pay any interest incurred on long-term debt. Two primary solvency ratios are the debt-to-disinterestedness ratio and the times interest earned ratio.

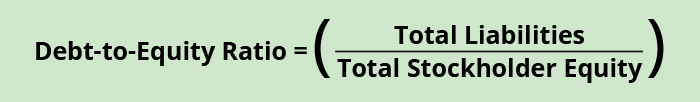

Debt to Equity Ratio

The debt-to-equity ratio shows the relationship between debt and disinterestedness as information technology relates to concern financing. A company can take out loans, event stock, and retain earnings to exist used in futurity periods to go on operations running. It is less risky and less costly to use equity sources for financing as compared to debt resource. This is mainly due to interest expense repayment that a loan carries equally opposed to equity, which does non have this requirement. Therefore, a visitor wants to know how much debt and equity contribute to its financing. Ideally, a visitor would prefer more equity than debt financing. The formula for the debt to equity ratio is:

The data needed to compute the debt-to-equity ratio for Banyan Goods in the current twelvemonth can be found on the rest sheet.

\(\text{Debt-to-equity ratio}=\left(\frac{?150,000}{?100,000}\right)=\text{ane.five or 1.v:ane}\)

This means that for every ?1 of disinterestedness contributed toward financing, ?1.50 is contributed from lenders. This would exist a concern for Banyan Goods. This could exist a blood-red flag for potential investors that the company could be trending toward insolvency. Banyan Goods might want to become the ratio beneath 1:one to improve their long-term business viability.

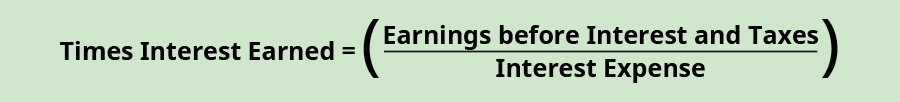

Times Involvement Earned Ratio

Time interest earned measures the company's power to pay involvement expense on long-term debt incurred. This power to pay is adamant by the bachelor earnings before interest and taxes (EBIT) are deducted. These earnings are considered the operating income. Lenders will pay attention to this ratio before extending credit. The more times over a company tin can cover interest, the more likely a lender will extend long-term credit. The formula for times interest earned is:

The information needed to compute times interest earned for Banyan Goods in the electric current year can be found on the income statement.

\(\text{Times involvement earned}=\left(\frac{?43,000}{?ii,000}\right)=21.v\phantom{\rule{0.2em}{0ex}}\text{times}\)

The ?43,000 is the operating income, representing earnings earlier interest and taxes. The 21.5 times result suggests that Banyan Goods can hands repay interest on an outstanding loan and creditors would take little chance that Banyan Appurtenances would be unable to pay.

Another category of fiscal measurement uses efficiency ratios.

Efficiency Ratios

Efficiency shows how well a company uses and manages their avails. Areas of importance with efficiency are management of sales, accounts receivable, and inventory. A visitor that is efficient typically volition be able to generate revenues quickly using the assets it acquires. Permit'south examine four efficiency ratios: accounts receivable turnover, total asset turnover, inventory turnover, and days' sales in inventory.

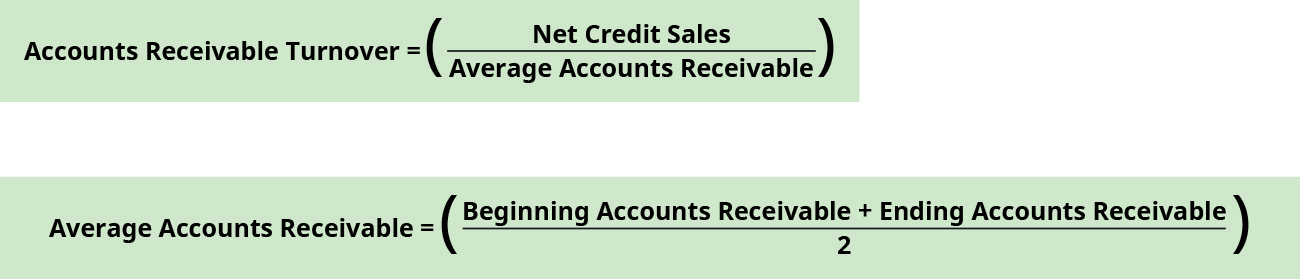

Accounts Receivable Turnover

Accounts receivable turnover measures how many times in a period (ordinarily a year) a company volition collect cash from accounts receivable. A college number of times could mean greenbacks is collected more rapidly and that credit customers are of high quality. A higher number is usually preferable because the greenbacks collected can be reinvested in the business at a quicker rate. A lower number of times could mean cash is collected slowly on these accounts and customers may not be properly qualified to have the debt. The formula for accounts receivable turnover is:

Many companies exercise not dissever credit and cash sales, in which case net sales would be used to compute accounts receivable turnover. Average accounts receivable is found by dividing the sum of beginning and catastrophe accounts receivable balances plant on the balance sail. The outset accounts receivable residual in the electric current year is taken from the ending accounts receivable balance in the prior twelvemonth.

When computing the accounts receivable turnover for Banyan Appurtenances, let's presume internet credit sales make up ?100,000 of the ?120,000 of the net sales found on the income statement in the current yr.

\(\begin{array}{ccc}\hfill \text{Boilerplate accounts receivable}& =\hfill & \frac{?20,000+?30,000}{two}=?25,000\hfill \\ \hfill \text{Accounts receivable turnover}& =\hfill & \frac{?100,000}{?25,000}=\text{4 times}\hfill \finish{array}\)

An accounts receivable turnover of four times per year may exist low for Banyan Goods. Given this event, they may want to consider stricter credit lending practices to brand sure credit customers are of a higher quality. They may also need to be more aggressive with collecting whatsoever outstanding accounts.

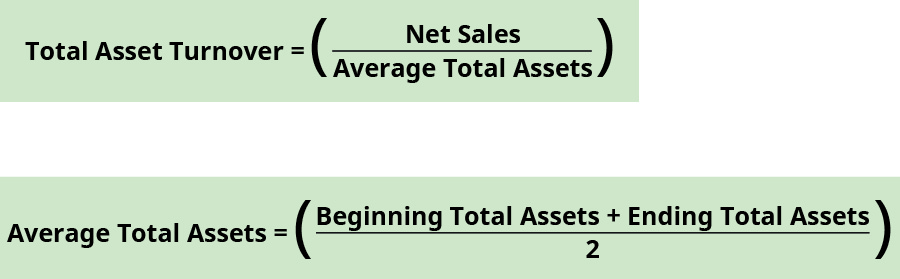

Total Asset Turnover

Full asset turnover measures the ability of a company to use their assets to generate revenues. A visitor would similar to apply as few assets as possible to generate the nigh cyberspace sales. Therefore, a higher total nugget turnover means the company is using their assets very efficiently to produce cyberspace sales. The formula for total asset turnover is:

Boilerplate total assets are constitute by dividing the sum of beginning and catastrophe total avails balances found on the balance canvas. The showtime total assets rest in the electric current year is taken from the ending total assets residual in the prior year.

Banyan Goods' total asset turnover is:

\(\begin{array}{ccc}\hfill \text{Boilerplate full avails}& =\hfill & \frac{?200,000+?250,000}{2}=?225,000\hfill \\ \hfill \text{Full assets turnover}& =\hfill & \frac{?120,000}{?225,000}=0.53\phantom{\rule{0.2em}{0ex}}\text{times (rounded)}\hfill \end{array}\)

The upshot of 0.53 means that for every ?one of assets, ?0.53 of cyberspace sales are generated. Over fourth dimension, Banyan Goods would like to see this turnover ratio increase.

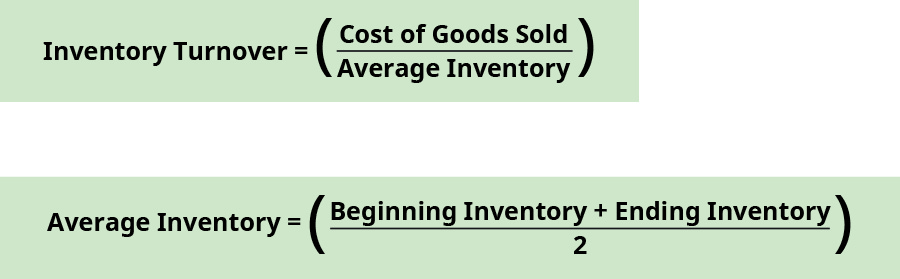

Inventory Turnover

Inventory turnover measures how many times during the year a company has sold and replaced inventory. This can tell a company how well inventory is managed. A higher ratio is preferable; however, an extremely high turnover may mean that the company does not have enough inventory bachelor to meet demand. A low turnover may mean the company has besides much supply of inventory on hand. The formula for inventory turnover is:

Price of goods sold for the current year is institute on the income argument. Average inventory is found by dividing the sum of beginning and catastrophe inventory balances found on the balance sheet. The outset inventory residuum in the current year is taken from the ending inventory balance in the prior yr.

Banyan Goods' inventory turnover is:

\(\begin{assortment}{ccc}\hfill \text{Boilerplate inventory}& =\hfill & \frac{?35,000+?40,000}{two}=?37,500\hfill \\ \hfill \text{Inventory turnover}& =\hfill & \frac{?60,000}{?37,500}=1.vi\phantom{\rule{0.2em}{0ex}}\text{times}\hfill \end{array}\)

1.6 times is a very depression turnover rate for Banyan Goods. This may mean the visitor is maintaining too loftier an inventory supply to meet a low need from customers. They may want to subtract their on-hand inventory to free up more liquid assets to utilize in other ways.

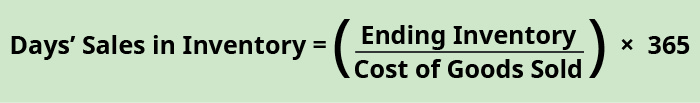

Days' Sales in Inventory

Days' sales in inventory expresses the number of days it takes a company to turn inventory into sales. This assumes that no new purchase of inventory occurred within that time period. The fewer the number of days, the more quickly the company can sell its inventory. The higher the number of days, the longer it takes to sell its inventory. The formula for days' sales in inventory is:

Banyan Goods' days' sales in inventory is:

\(\text{Days' sales in inventory}=\left(\frac{?40,000}{?threescore,000}\right)\phantom{\rule{0.2em}{0ex}}×\phantom{\rule{0.2em}{0ex}}365=243\phantom{\rule{0.2em}{0ex}}\text{days (rounded)}\)

243 days is a long fourth dimension to sell inventory. While manufacture dictates what is an acceptable number of days to sell inventory, 243 days is unsustainable long-term. Banyan Goods will need to better manage their inventory and sales strategies to motility inventory more chop-chop.

The concluding category of financial measurement examines profitability ratios.

Profitability Ratios

Profitability considers how well a visitor produces returns given their operational operation. The company needs to leverage its operations to increment profit. To aid with profit goal attainment, company revenues need to outweigh expenses. Permit'south consider three profitability measurements and ratios: profit margin, return on full assets, and return on equity.

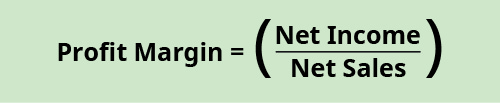

Profit Margin

Profit margin represents how much of sales revenue has translated into income. This ratio shows how much of each ?ane of sales is returned as profit. The larger the ratio effigy (the closer it gets to i), the more of each sales dollar is returned every bit profit. The portion of the sales dollar not returned as profit goes toward expenses. The formula for profit margin is:

For Banyan Goods, the profit margin in the current year is:

\(\text{Profit margin}=\left(\frac{?35,000}{?120,000}\right)=0.29\phantom{\rule{0.2em}{0ex}}\text{(rounded)}\phantom{\rule{0.2em}{0ex}}\text{or}\phantom{\rule{0.2em}{0ex}}29%\)

This ways that for every dollar of sales, ?0.29 returns as profit. If Banyan Goods thinks this is likewise low, the visitor would endeavor and discover ways to reduce expenses and increase sales.

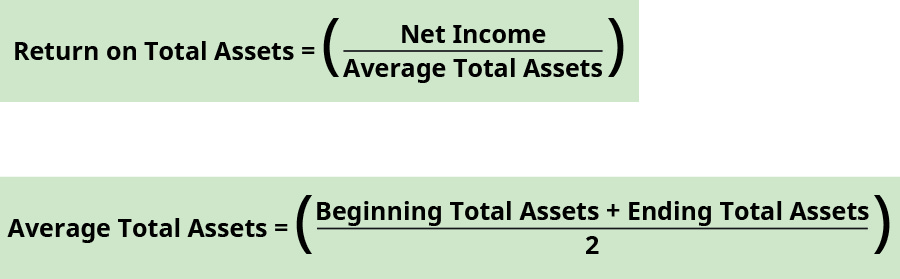

Return on Full Assets

The render on total assets measures the company's ability to use its assets successfully to generate a profit. The higher the render (ratio outcome), the more turn a profit is created from asset use. Average total assets are institute by dividing the sum of kickoff and ending total assets balances found on the remainder sheet. The beginning total avails balance in the current twelvemonth is taken from the catastrophe total avails residual in the prior year. The formula for return on total assets is:

For Banyan Appurtenances, the return on total assets for the current twelvemonth is:

\(\begin{array}{ccc}\hfill \text{Average full assets}& =\hfill & \frac{?200,000+?250,000}{2}=?225,000\hfill \\ \hfill \text{Return on full assets}& =\hfill & \frac{?35,000}{?225,000}=0.16\phantom{\rule{0.2em}{0ex}}\text{(rounded) or xvi%}\hfill \end{array}\)

The higher the effigy, the better the company is using its assets to create a turn a profit. Industry standards tin dictate what is an acceptable return.

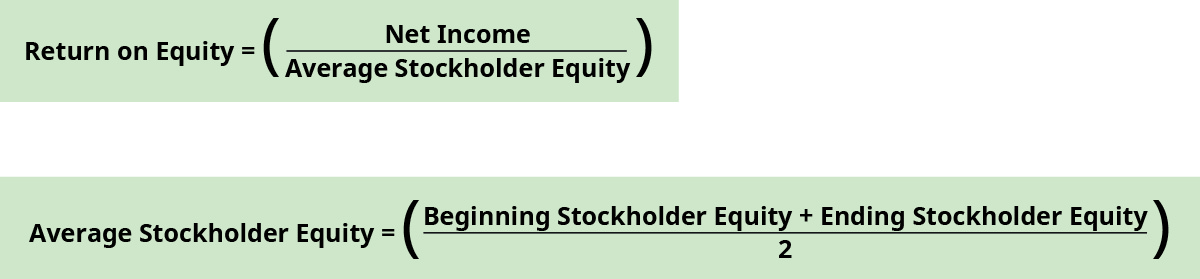

Return on Disinterestedness

Return on disinterestedness measures the company's ability to apply its invested capital to generate income. The invested capital comes from stockholders investments in the company's stock and its retained earnings and is leveraged to create profit. The higher the return, the better the company is doing at using its investments to yield a profit. The formula for return on disinterestedness is:

Average stockholders' equity is found by dividing the sum of beginning and ending stockholders' disinterestedness balances institute on the balance sheet. The showtime stockholders' equity balance in the current year is taken from the catastrophe stockholders' disinterestedness balance in the prior twelvemonth. Keep in mind that the internet income is calculated after preferred dividends accept been paid.

For Banyan Goods, we will utilise the net income effigy and assume no preferred dividends have been paid. The return on equity for the electric current year is:

\(\begin{array}{ccc}\hfill \text{Boilerplate stockholder disinterestedness}& =\hfill & \frac{?90,000+?100,000}{two}=?95,000\hfill \\ \hfill \text{Return on equity}& =\hfill & \frac{?35,000}{?95,000}=0.37\phantom{\rule{0.2em}{0ex}}\text{(rounded) or 37%}\hfill \end{array}\)

The higher the effigy, the better the company is using its investments to create a profit. Industry standards can dictate what is an adequate render.

Advantages and Disadvantages of Financial Statement Analysis

In that location are several advantages and disadvantages to financial statement analysis. Financial argument assay can show trends over time, which can exist helpful in making future business decisions. Converting information to percentages or ratios eliminates some of the disparity between competitor sizes and operating abilities, making it easier for stakeholders to brand informed decisions. It tin can assist with understanding the makeup of current operations within the business concern, and which shifts demand to occur internally to increase productivity.

A stakeholder needs to keep in mind that by performance does not always dictate time to come performance. Attention must be given to possible economical influences that could skew the numbers beingness analyzed, such as inflation or a recession. Additionally, the way a company reports information within accounts may change over time. For example, where and when sure transactions are recorded may shift, which may non be readily axiomatic in the financial statements.

A company that wants to budget properly, control costs, increase revenues, and make long-term expenditure decisions may want to employ fiscal statement analysis to guide futurity operations. Equally long as the visitor understands the limitations of the information provided, financial statement analysis is a proficient tool to predict growth and visitor financial strength.

Which Of The Following Is The Most Useful In Analyzing Companies Of Different Sizes?,

Source: https://opentextbc.ca/principlesofaccountingv1openstax/back-matter/financial-statement-analysis/

Posted by: pattersonwirciang.blogspot.com

0 Response to "Which Of The Following Is The Most Useful In Analyzing Companies Of Different Sizes?"

Post a Comment